Building a Financial Support Platform for First-Gen Immigrants

BRIEF

A guided learning hub for first-generation immigrants, where confusing U.S. financial decisions become simple, guided scenarios with personalized support.

MY CONTRIBUTIONS

User Research

UX/UI

User Testing

MY TOOLS

Figma

Miro

Google Docs

DURATION

9 Weeks

MY TEAM

Arpitha Prasad

Xin (Raven) Jiang

Overview

What does it take to navigate a financial system that was never designed for you?

First-generation immigrants face one of the most overwhelming transitions of all: stepping into a financial system built on unfamiliar language, rules, and expectations. We wanted to reimagine that moment as an entry point into clarity and control instead of a barrier.

Over nine weeks, my team and I explored how design, education, and cultural context could work together to make this system feel human and welcoming instead of intimidating. How can we simplify something even lifelong Americans struggle to understand, and help first-generation immigrants feel not just informed, but genuinely empowered?

DISCOVERY

Listening to First-Generation Immigrant Voices

To design a product that truly resonates with first-generation immigrants, I looked into existing literature to understand how they think, feel, and navigate the challenges of adapting to a new environment.

What I Learned

A "one size fits all" system doesn’t fit everyone

The U.S. financial system rarely accounts for different cultural roles, values, or religious constraints, forcing immigrants into rules that dont fit their lifestyle.

A "one size fits all" system doesn’t fit everyone

The U.S. financial system rarely accounts for different cultural roles, values, or religious constraints, forcing immigrants into rules that dont fit their lifestyle.

Immigrants rely on informal networks first

Immigrants rely on informal community networks more than formal financial education, often asking family and friends for guidance before seeking out official resources.

Immigrants rely on informal networks first

Immigrants rely on informal community networks more than formal financial education, often asking family and friends for guidance before seeking out official resources.

CBOs and ESL programs bridge language, but lack financial expertise.

This leaves immigrants with trusted guides who can translate, but not fully advise and build a proper foundation for success

CBOs and ESL programs bridge language, but lack financial expertise.

This leaves immigrants with trusted guides who can translate, but not fully advise and build a proper foundation for success

Hearing First-Gen Realities

Desk research gave me patterns, but not the direct understanding. To explore those insights, we conducted semi-structured interviews with first-generation immigrants and asked them to walk through their experiences with the U.S. financial system.

What We Heard from Participants

Lost in the Jargon

"I don't think they do a good job of making the explanations understandable … technical jargon is explained using more technical jargon."

High Stakes for Small Decisions

"I was just worried that if I do something wrong... or get into legal trouble."

No Resources, No Roadmap

""I lacked the resources and I didn't know how I was even supposed to navigate it [The System]. "

Together, these stories revealed a common thread: first-generation immigrants are trying to navigate a system they were never prepared for. Clear explanations and accessible resources are rarely available, creating a lingering fear that one wrong move could have serious consequences.

Mapping The Mind

As my team and I reviewed our interviews, we needed a structured way to organize what we were hearing across participants. I pulled key quotes onto sticky notes and laid them out as a mental model of the first-generation immigrant financial journey.

Mental Model

Mental Model

During synthesis, I clustered our user data into tall “towers” of blue sticky notes. Each “tower” held a recurring theme, from getting initial guidance and finding information to dealing with emotional barriers and long-term goals. Once those towers were in place, it became much easier to see the bigger patterns and conceptualize potential features that could speak to each need.

OPPORTUNITY

How might we help first-generation immigrants confidently learn and understand the U.S. financial system?

IDEATION

It shouldn’t feel like a maze

The U.S. financial system is already intimidating, but for first-generation immigrants it comes layered with new jargon, unfamiliar rules, and paperwork in a language and culture they’re still learning. We wanted our product to feel less like navigating a distant bureaucracy and more like stepping into a friendly, low-pressure space where first-generation immigrants can get oriented, ask questions, and make decisions at their own pace.

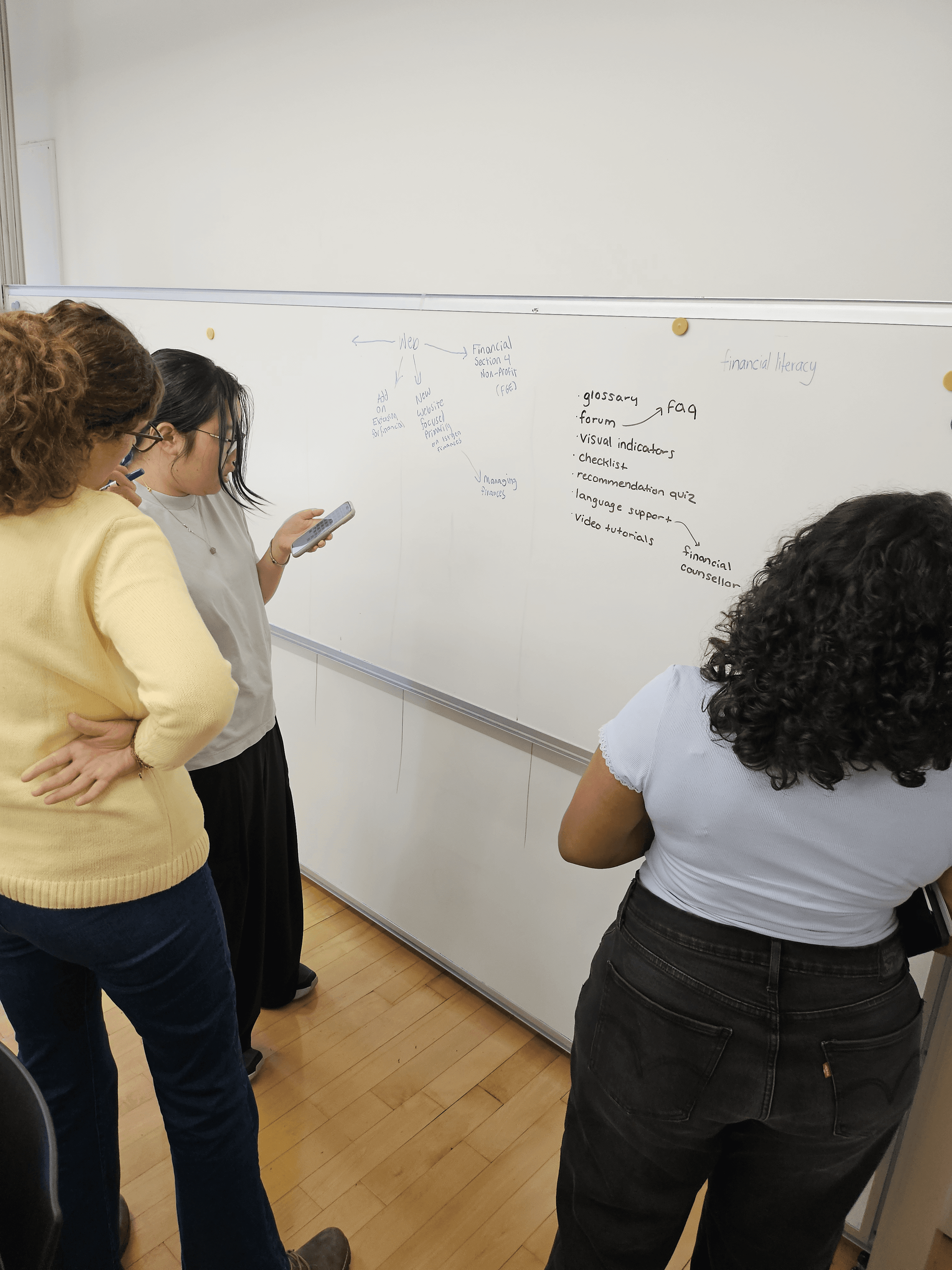

Our Initial Idea: a resource hub + browser helper

Our first concept was a centralized web resource hub. We wanted our users to have a place to gather trustworthy articles, easy to understand terminology, and personalized checklists so first-generation immigrants wouldn’t have to piece information together across dozens of tabs.

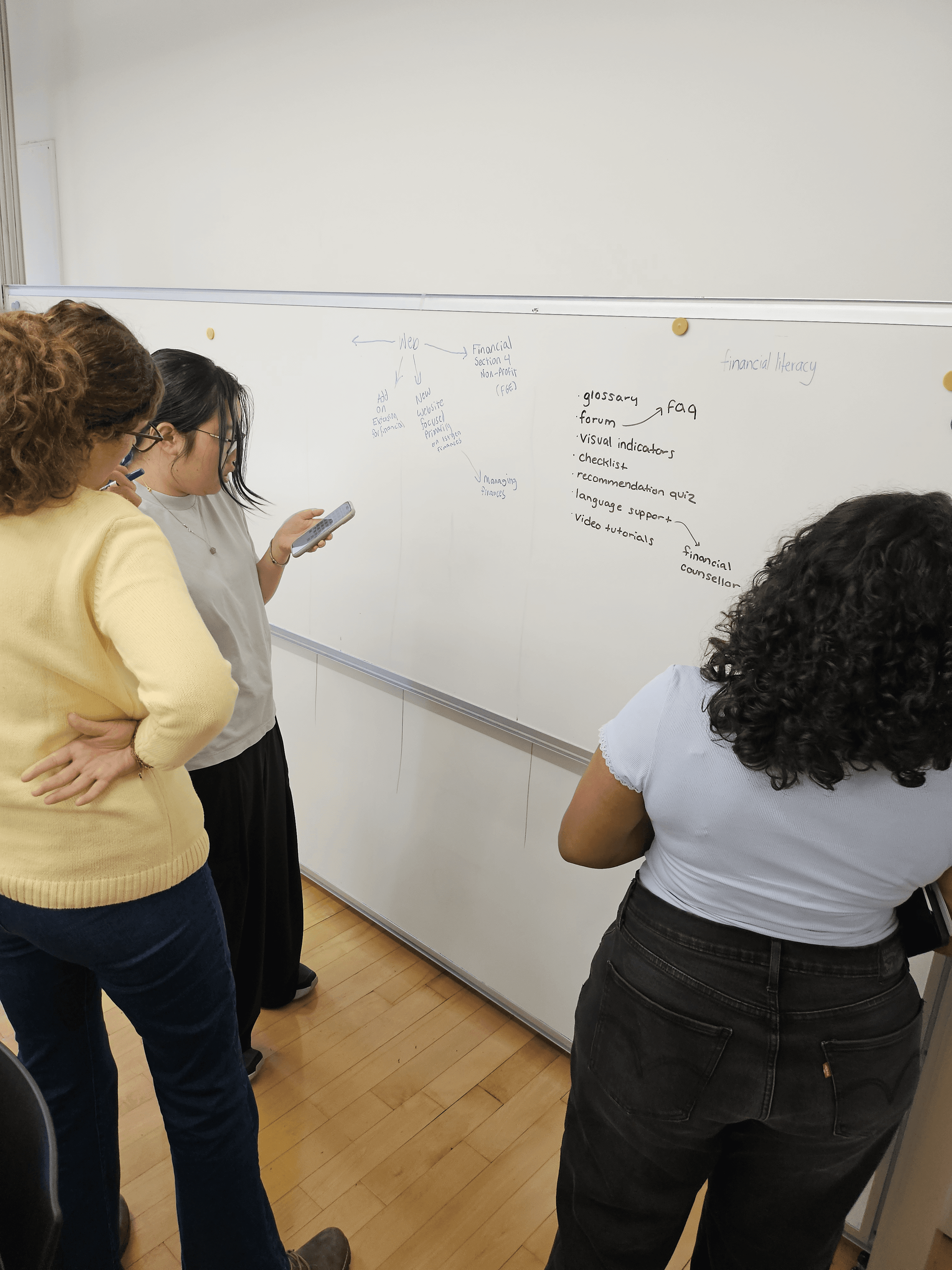

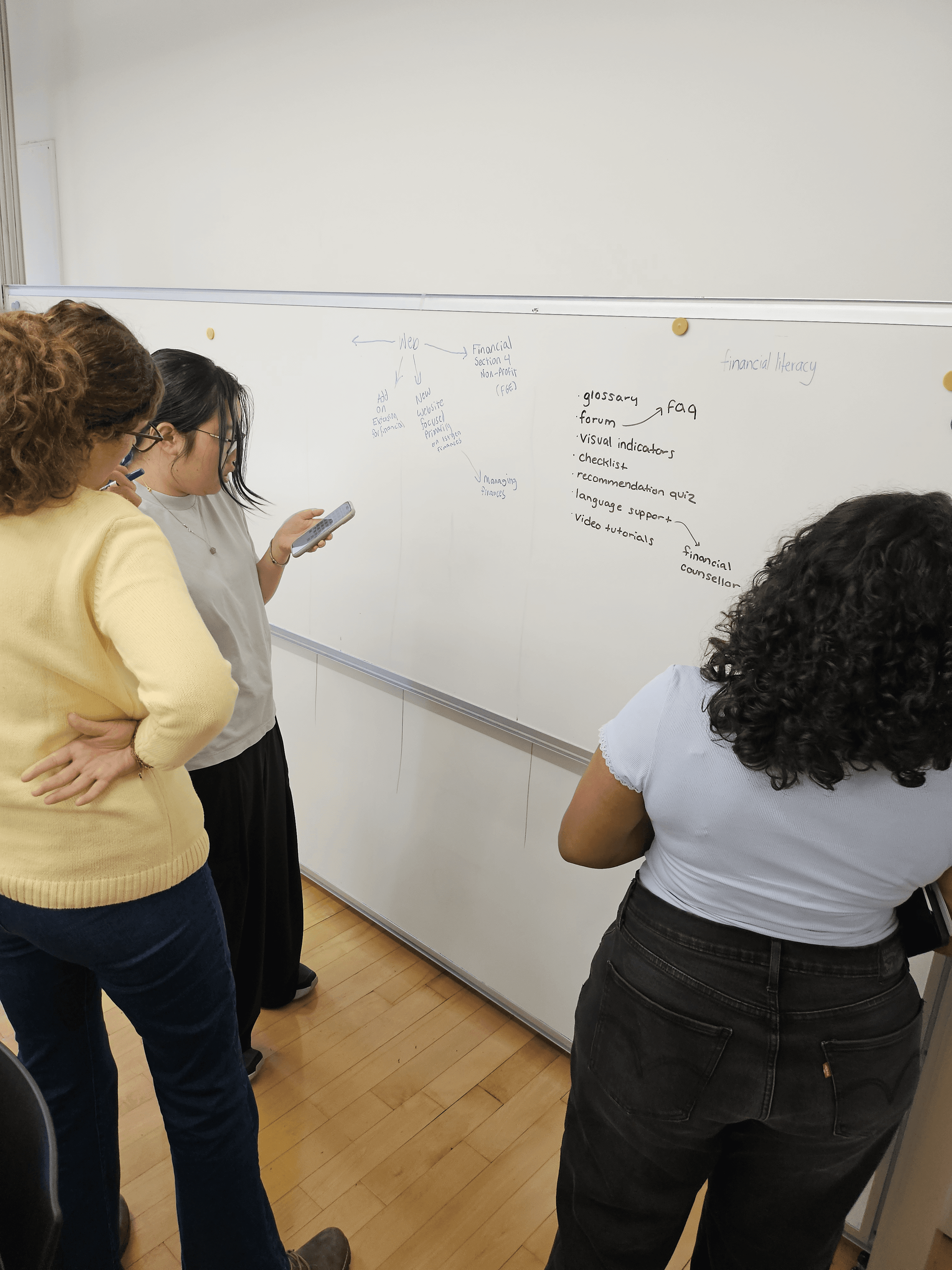

My team and I brainstorming product concepts based on our research insights

While this addressed the problem of fragmented information, it still felt like a passive, overwhelming library of information rather than a supportive companion, and it didn’t fully speak to the emotional side of learning or the fear of “messing up” that surfaced in research.

From static library to an adaptive, gamified journey

Our goal shifted from simply “organizing information” to something more interactive. After synthesis, we had a eureka moment: what if, instead of a static library, we reimagined an app as a gamified companion? What if it broke the U.S. financial system into small, doable steps, personalized to each learner and focused on building confidence over time?

A visual replay of our eureka moment from our late-night texts.

REFINEMENT

Working on the Interface

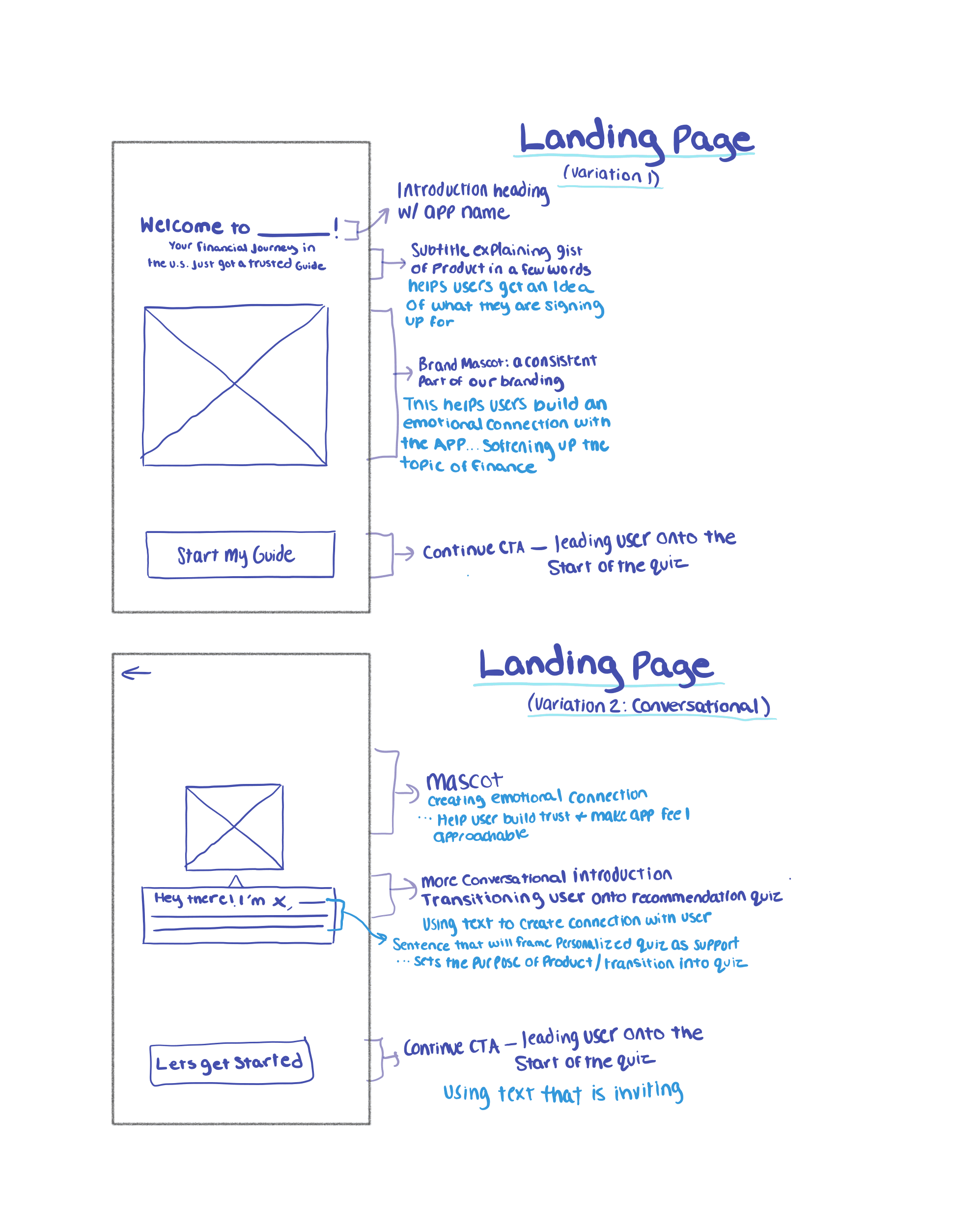

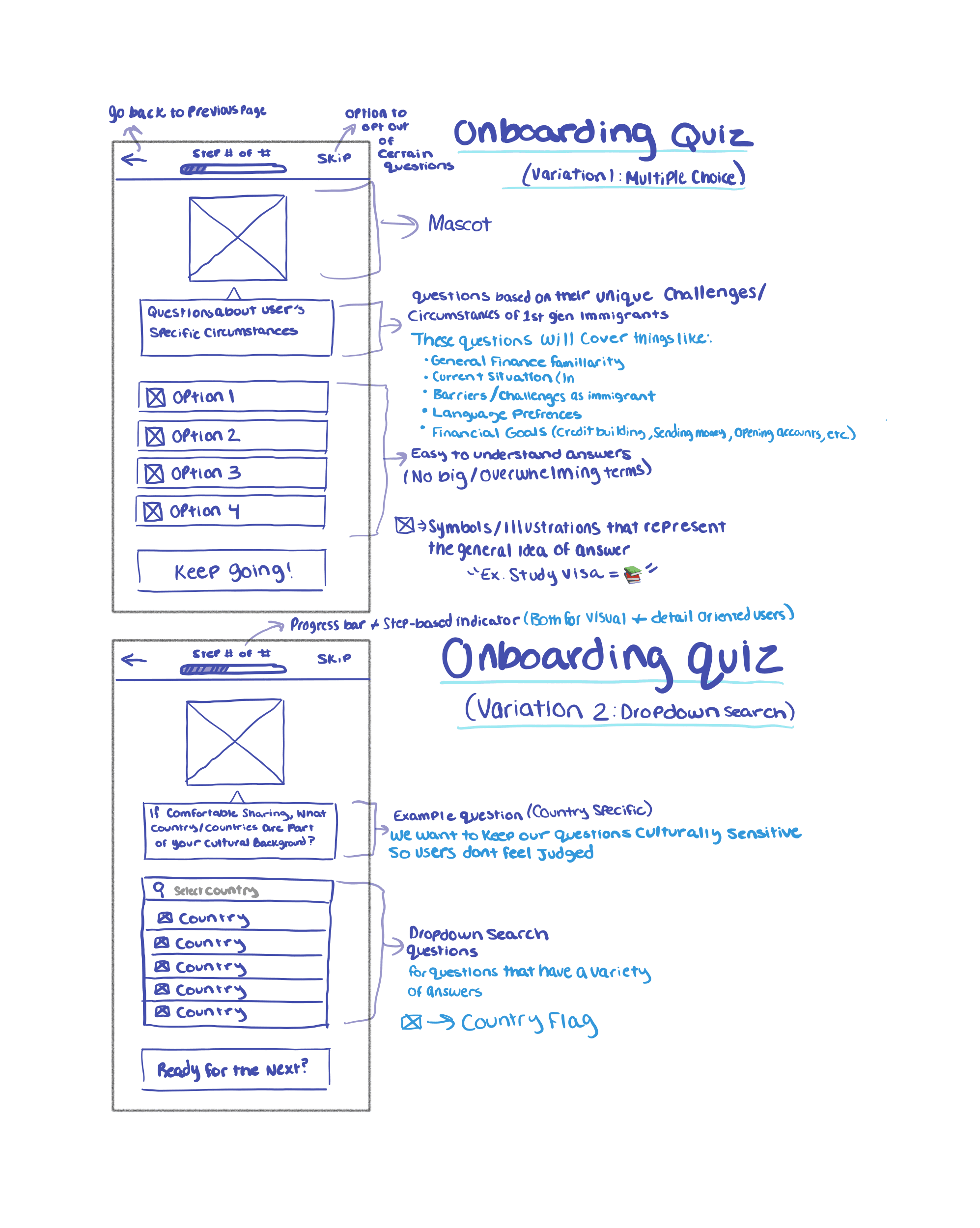

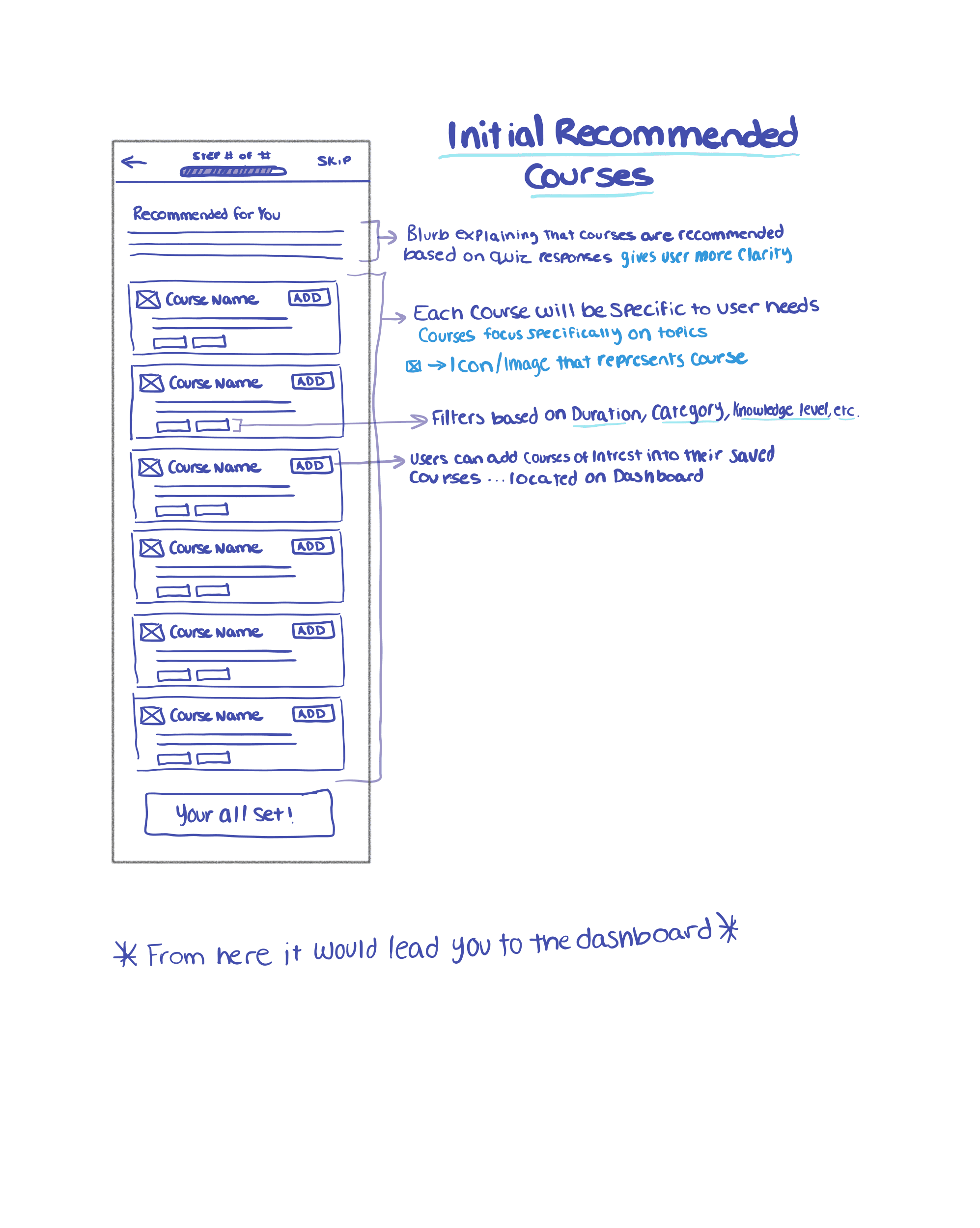

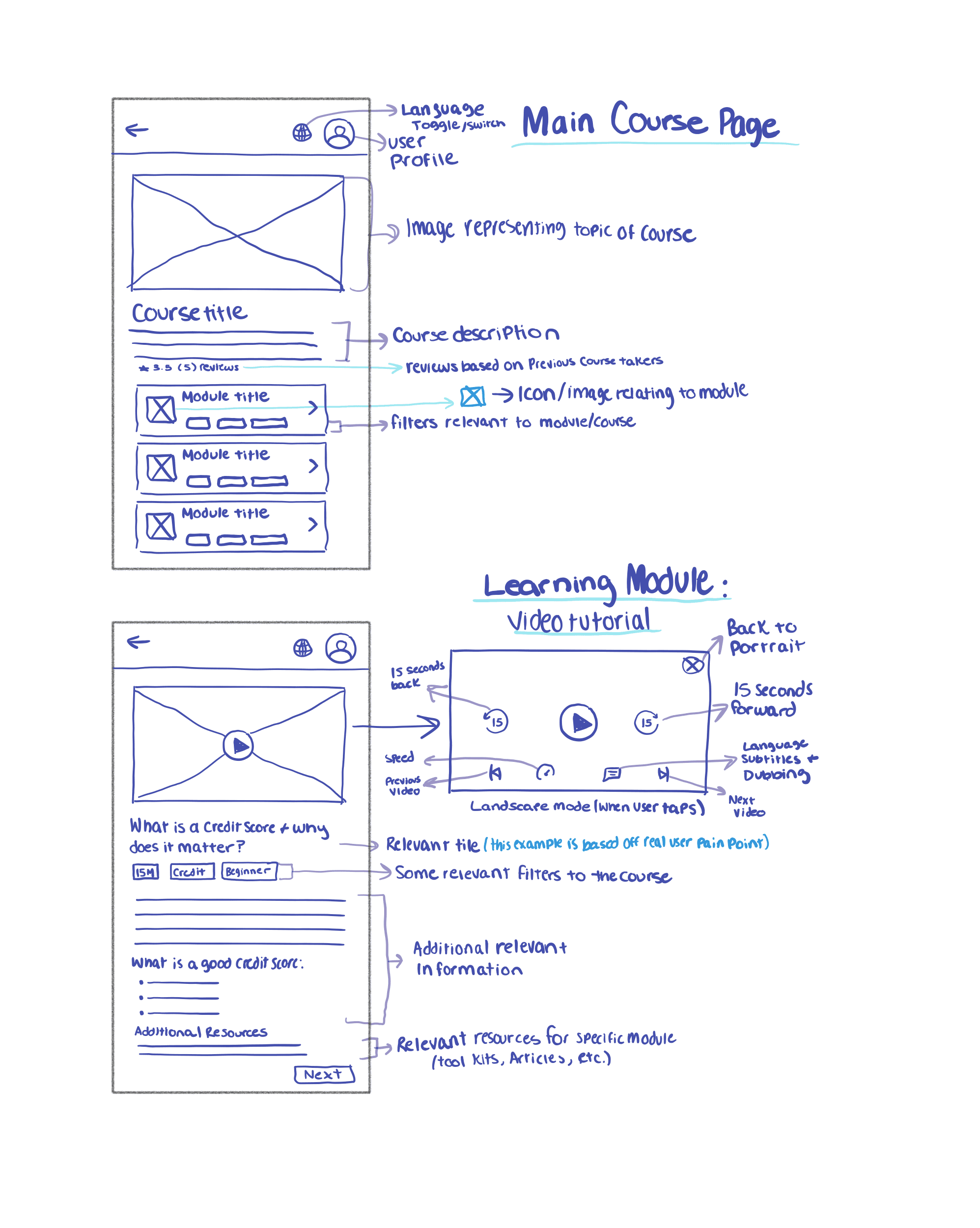

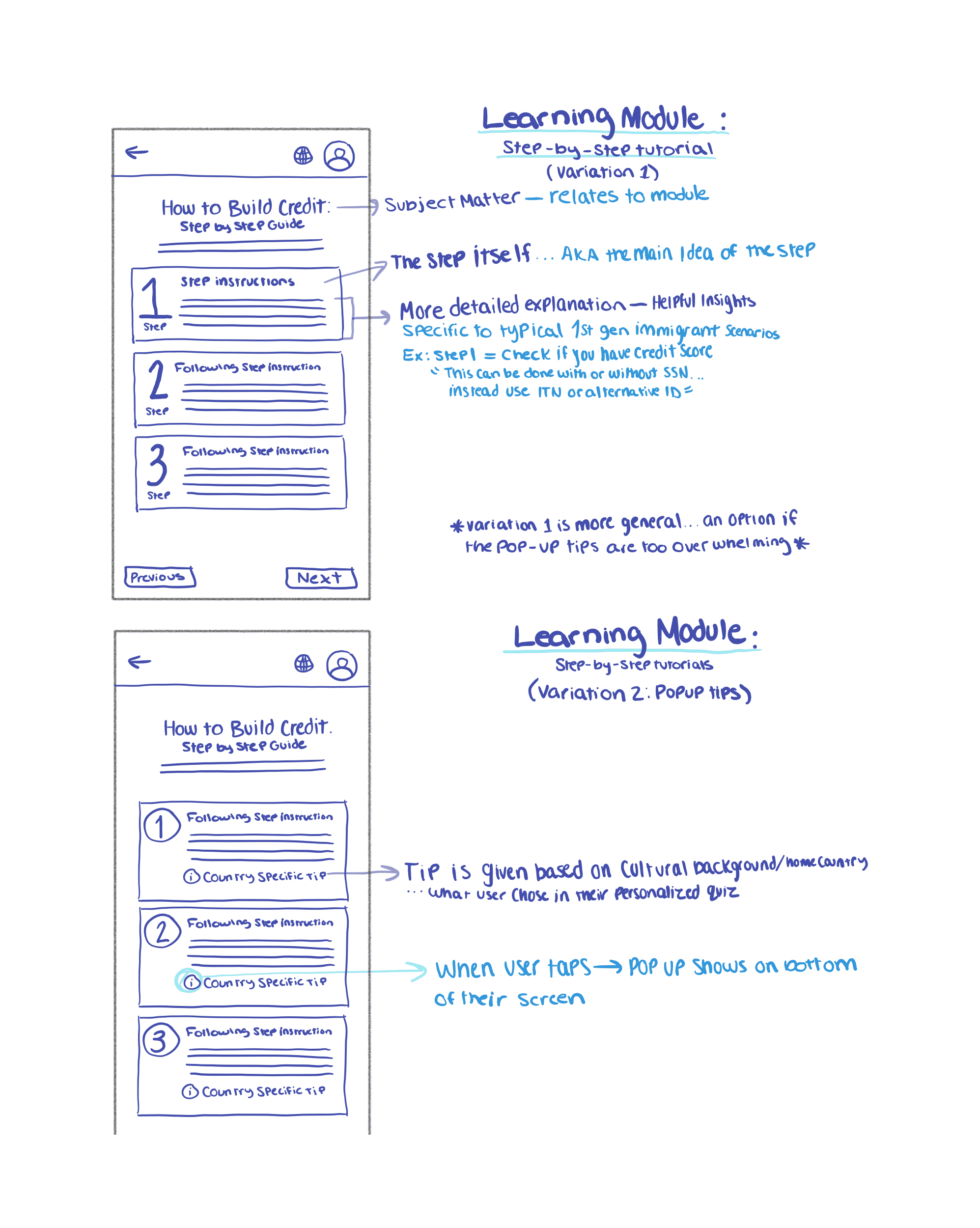

For a more personalized experience, I sketched out different iterations of a personalized onboarding and content experience. I wanted to test how a gamified path would feel from the initial starting point and how it connected to our user's way of thinking.

Because of our time constraints, we kept the course content in low fidelity as a placeholder for future iterations and I focused my mid-fidelity work on the personalized onboarding flow, since onboarding would shape everything a user saw next in their learning path.

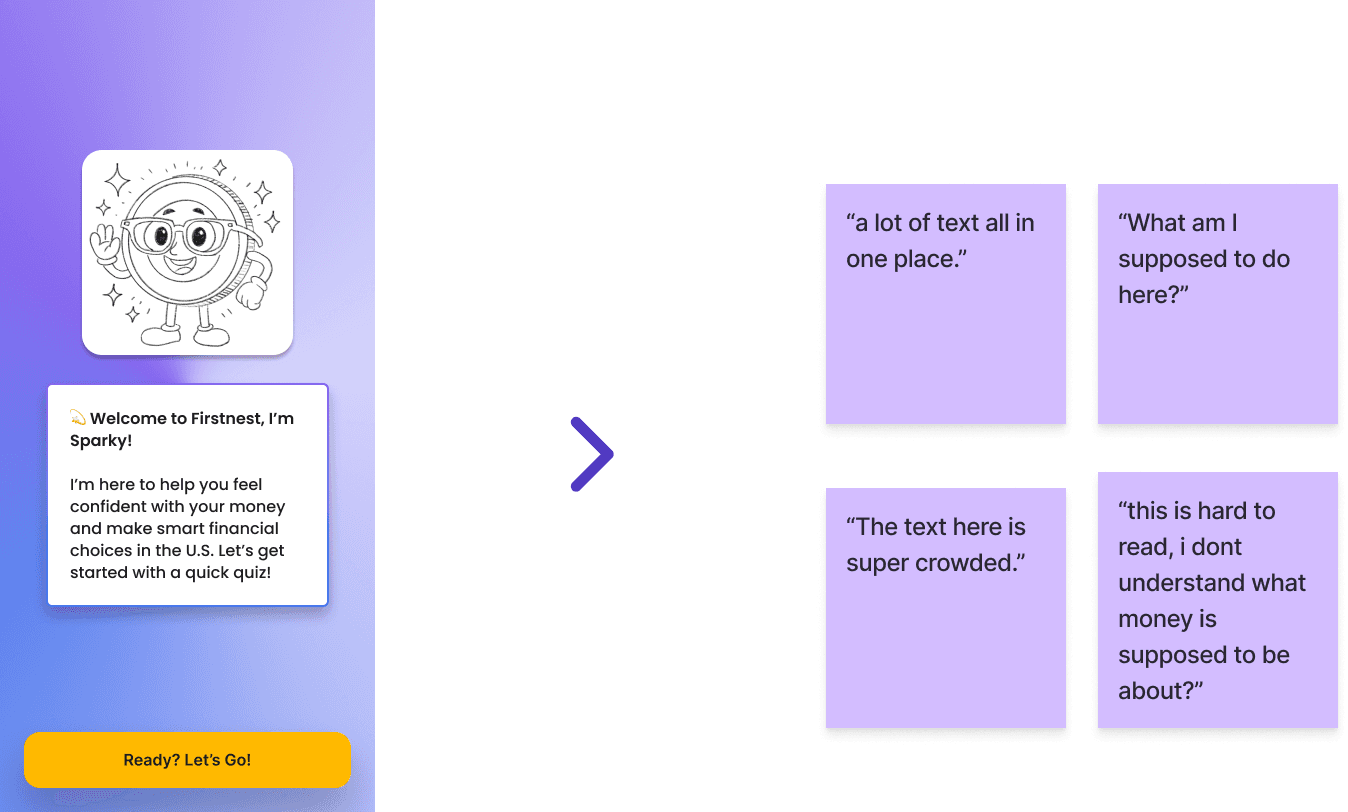

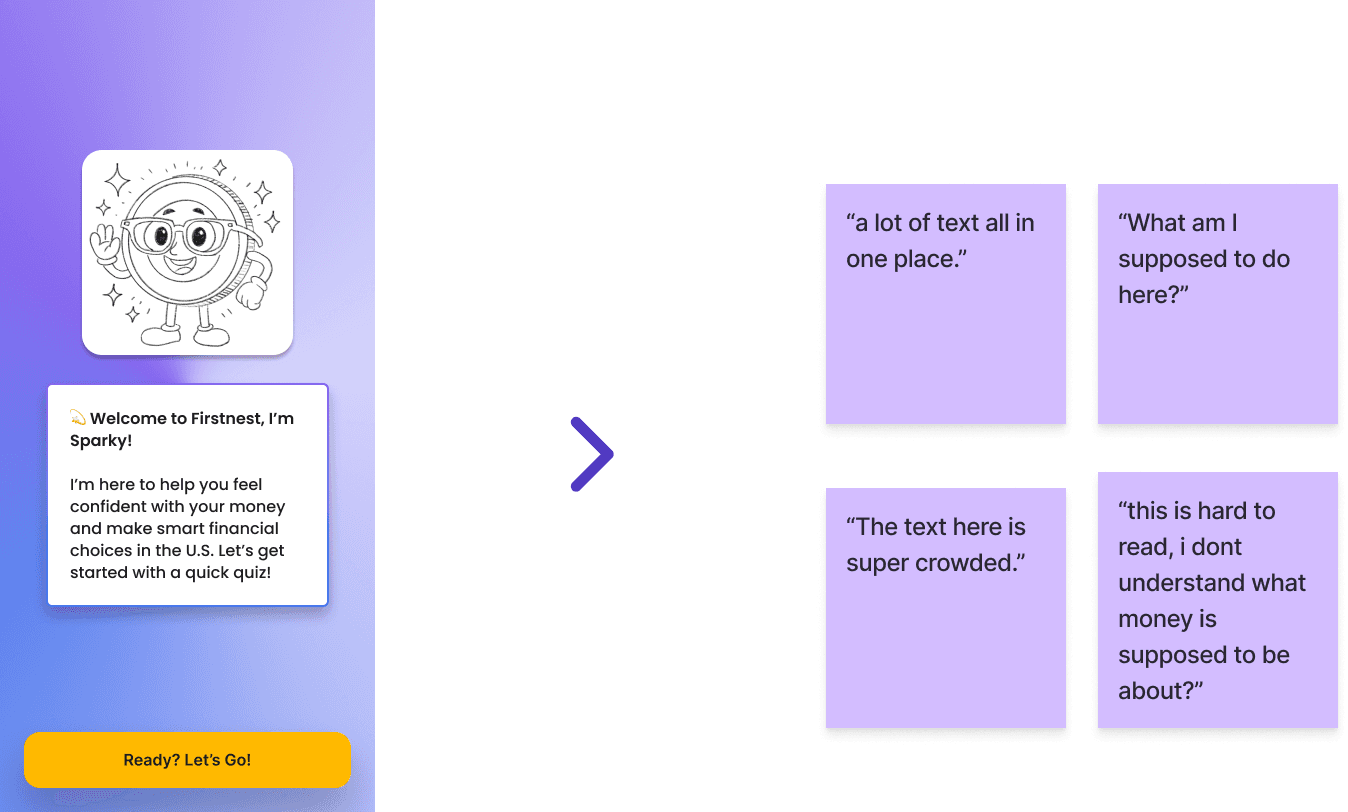

Where the Flow Worked and Where It Didn’t

While our half-baked prototypes were slowly coming together, we wanted to get honest feedback and watch where they actually worked, where they fell apart, and what first-generation immigrants had to say about them.

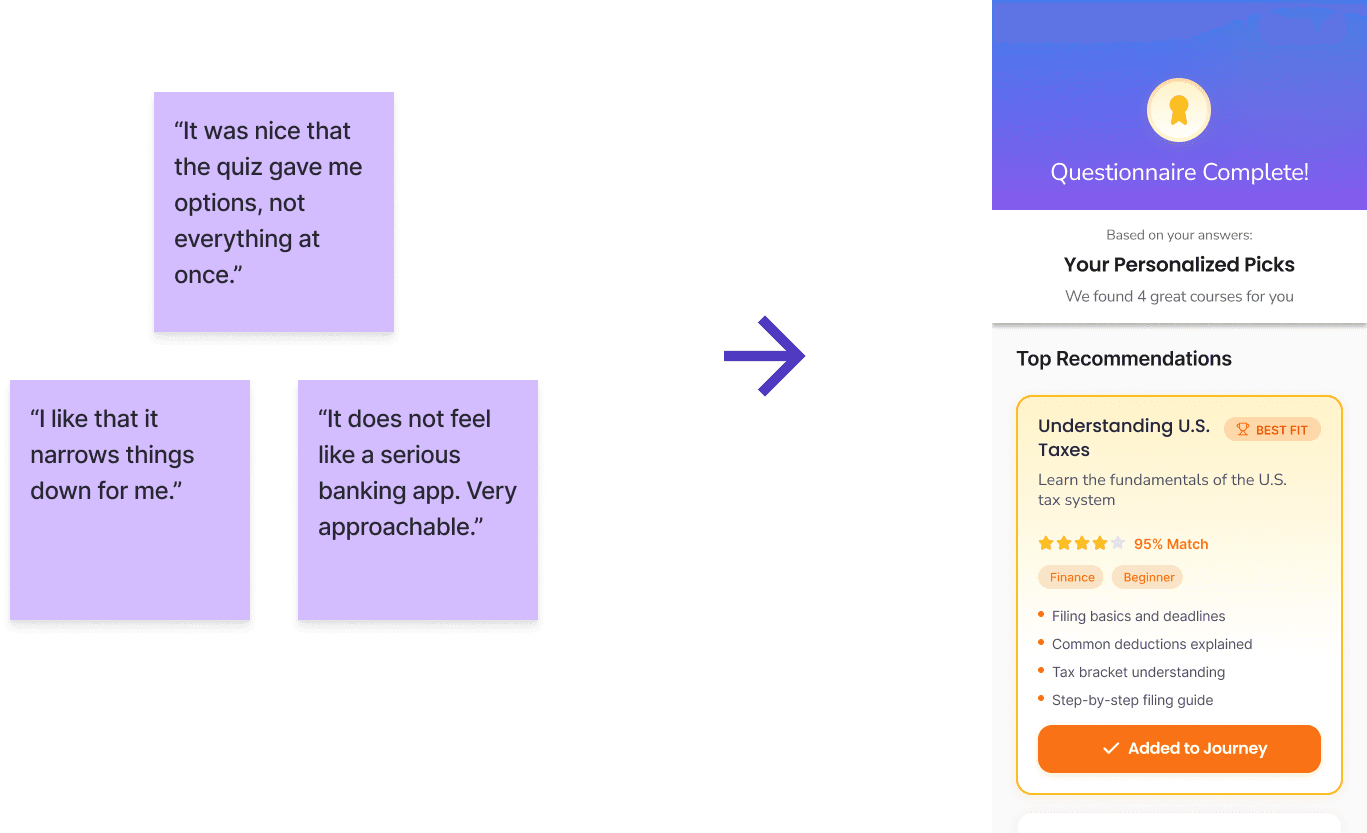

01 Personalization is a core concept

Participants responded well to getting a tailored set of options instead of being dropped into “everything at once,” which told us to keep personalization as a main element of our design.

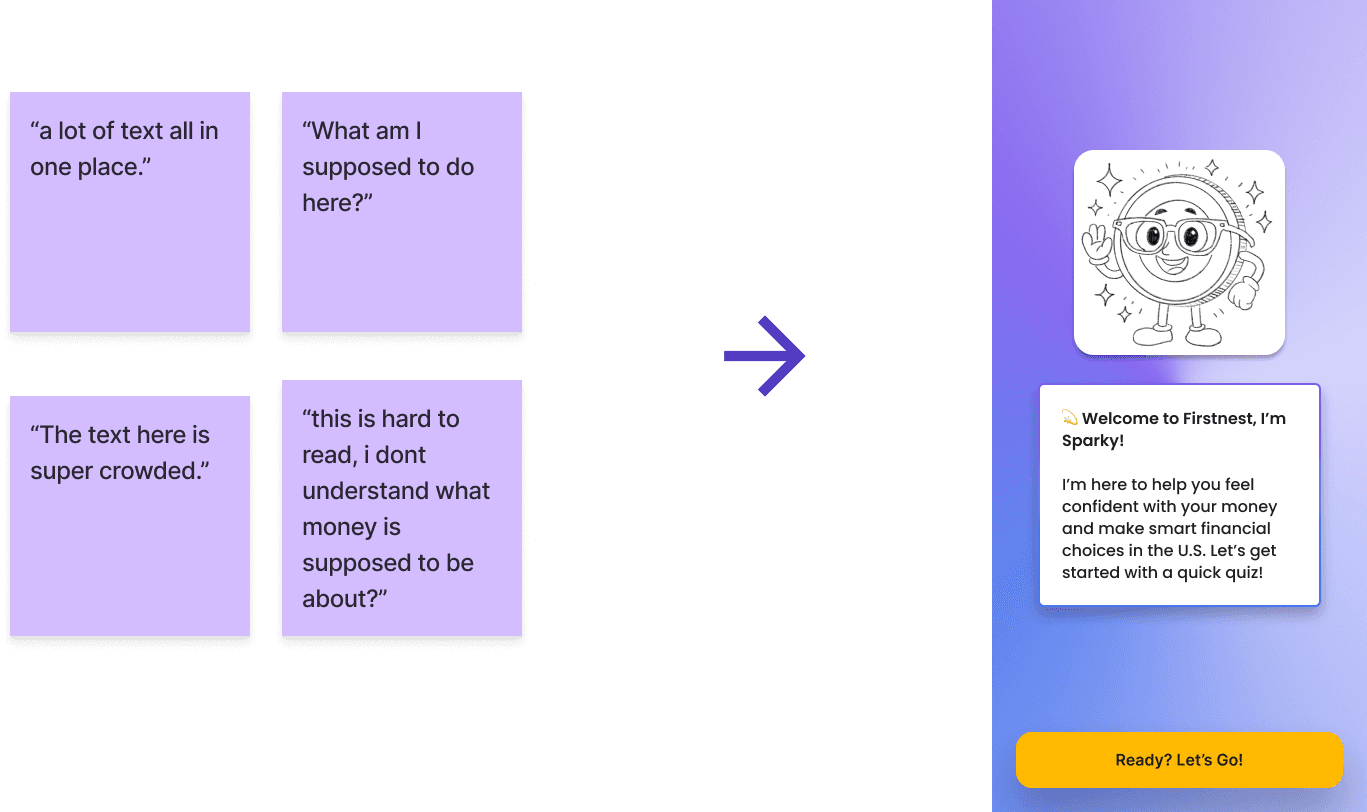

02 The flow works, but the words don’t

The overall flow felt intuitive but the content on our initial iterations needed work. Vague questions and dense paragraphs made it hard for users to understand what was being asked of them, so our next step was making our words intentional and breaking information into smaller, scannable chunks.

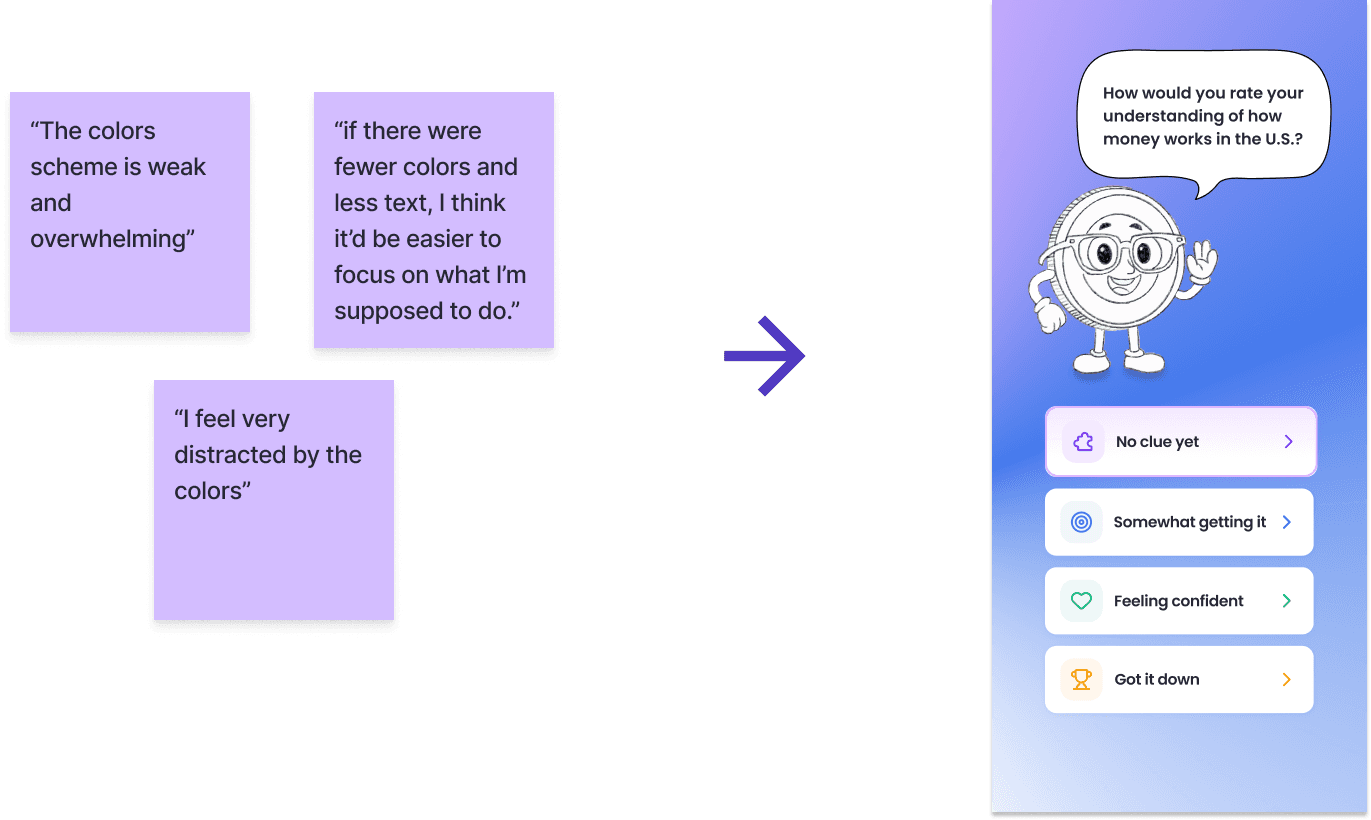

03 Approachable Tone, Distracting Visuals

Participants described the interface as friendly and approachable, which validated our mascot and conversational tone. At the same time, the visuals felt “distracting,” so we opted for less colors in our palette for the final design.

FINAL DESIGN

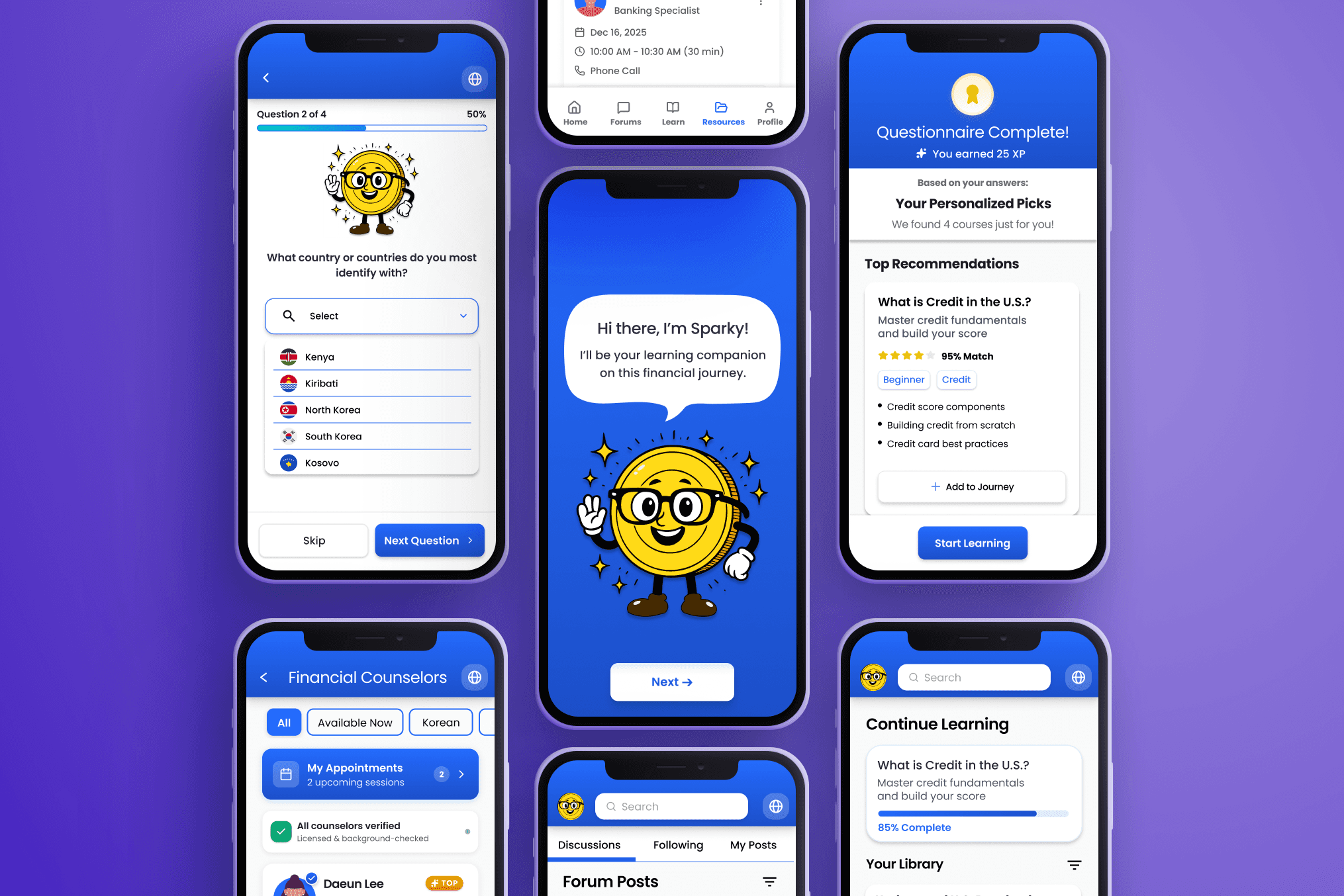

Introducing, First Spark

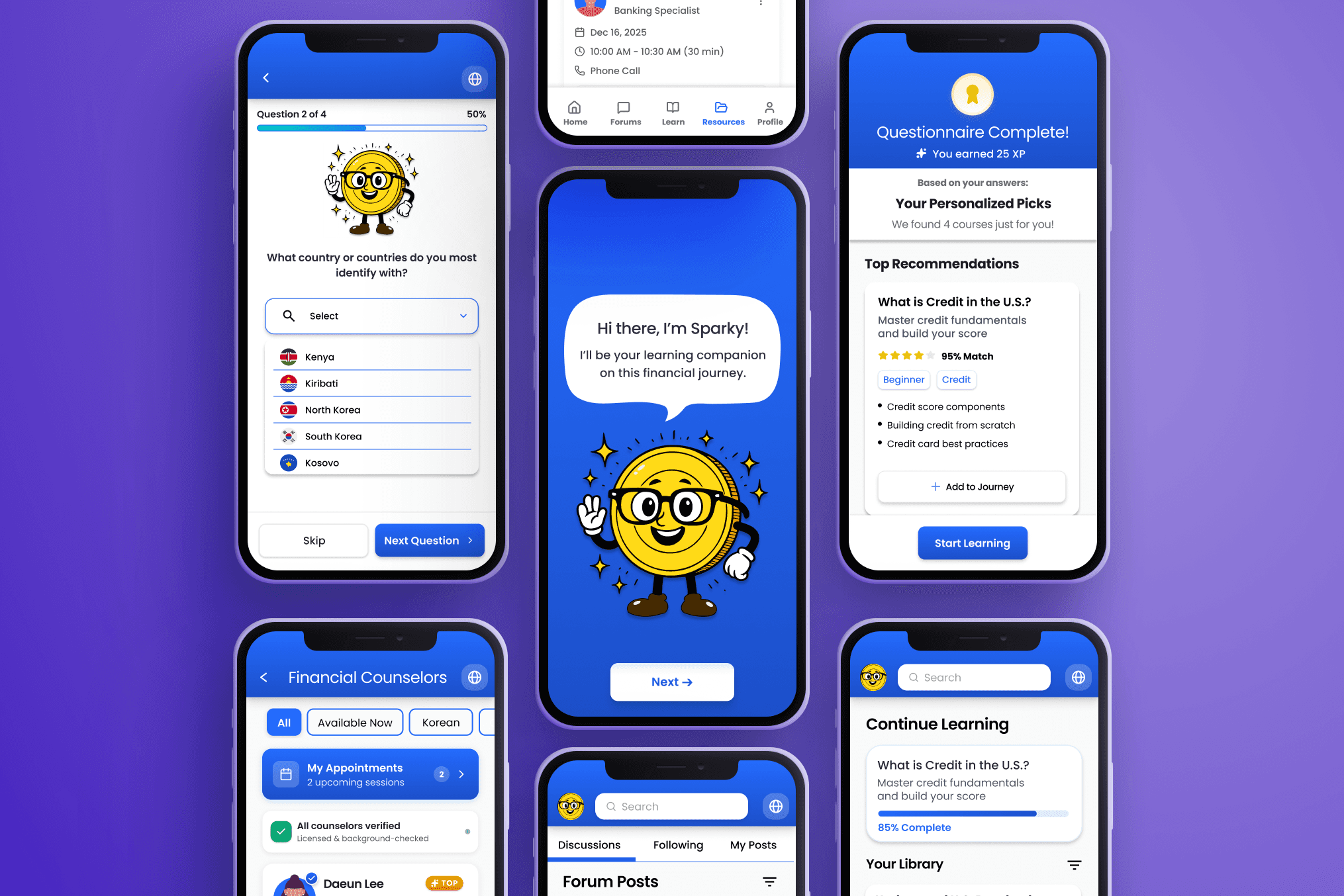

First Spark is a financial support app that gives first-generation immigrants personalized paths and support as they navigate the U.S. system. Instead of "one size fits all" content, it adapts to each person’s language, comfort level, and goals, offering culturally tailored lessons, plain-language help, and human guidance when they need it most.

Personalized recommendations from the start

Instead of a wall of content, First Spark creates content based on each user’s language, goals, and comfort with the U.S. financial system, resulting in a step by step path that meets them where they are at.

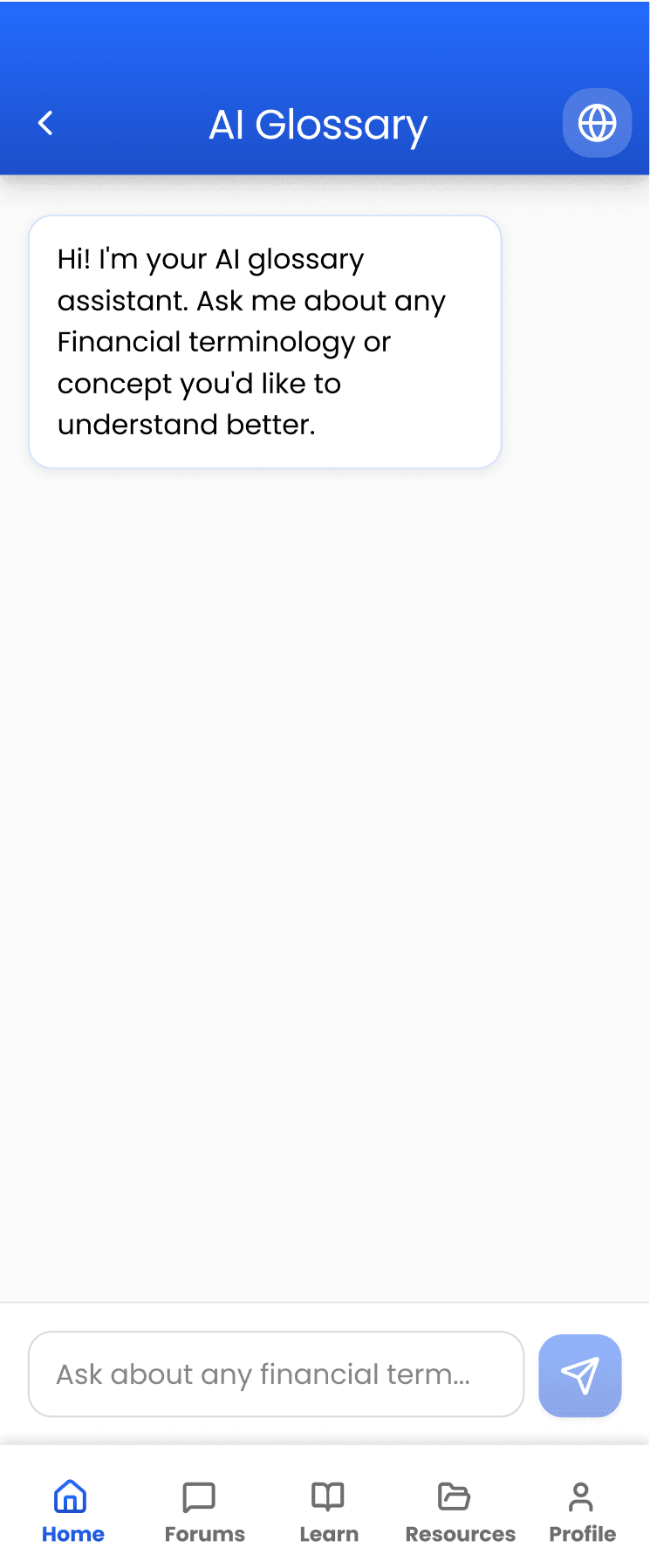

Extra clarity when things get confusing

As users move through their path, an AI glossary, language toggles, and cultural tips appear in tandem each lesson, turning confusing terms into plain language and connecting them to familiar context right when they’re needed.

No one has to navigate this alone

As a first-generation immigrant, you’re not left to figure it out alone. You can browse stories from people with similar backgrounds, ask questions in a safe space, and reach out to counselors who share your language or culture.

What I learned along the way

01

Designing for a Specific Someone, Not “Everyone”

To design effective onboarding, you can’t aim at a generic “learner.” This project showed me that every choice (from wording to concepts) had to be grounded in the lived realities of first-generation immigrants, even when their goals look similar on the surface to everyone else’s.

02

Less Really Is More

When conducting user testing, I saw that “engaging” visuals and dense content often had an opposite effect. It added noise and made it harder to understand what to do next. In the future I plan to use calmer layouts, fewer colors, and shorter chunks of text as they seem to better support focus and reduce anxiety.

03

Staying in Sketch Mode Longer

Moving quickly to polished screens felt impactful, but next time I would let the onboarding stay in low and mid-fidelity longer, test more variations, and tune product content around what actually supports first-generation immigrants.

Building a Financial Support Platform for First-Gen Immigrants

Building a Financial Support Platform for First-Gen Immigrants

Building a Financial Support Platform for First-Gen Immigrants

BRIEF

BRIEF

BRIEF

A research-driven overhaul of a secure client portal, where confusing menus and labels become clear paths to the tasks customers use every day.

A research-driven overhaul of a secure client portal, where confusing menus and labels become clear paths to the tasks customers use every day.

A research-driven overhaul of a secure client portal, where confusing menus and labels become clear paths to the tasks customers use every day.

MY CONTRIBUTIONS

User Research

User Testing

UX Design

User Research

User Testing

UX Design

User Research

User Testing

UX Design

MY TEAM

1 Product Designer

2 Developers

DURATION

3 months

Overview

What does it take to navigate a financial system that was never designed for you?

First-generation immigrants face one of the most overwhelming transitions of all: stepping into a financial system built on unfamiliar language, rules, and expectations. We wanted to reimagine that moment as an entry point into clarity and control instead of a barrier.

Over nine weeks, my team and I explored how design, education, and cultural context could work together to make this system feel human and welcoming instead of intimidating. How can we simplify something even lifelong Americans struggle to understand, and help first-generation immigrants feel not just informed, but genuinely empowered?

DISCOVERY

Listening to First-Generation Immigrant Voices

To design a product that truly resonates with first-generation immigrants, I looked into existing literature to understand how they think, feel, and navigate the challenges of adapting to a new environment.

What I Learned

A "one size fits all" system doesn’t fit everyone

The U.S. financial system rarely accounts for different cultural roles, values, or religious constraints, forcing immigrants into rules that dont fit their lifestyle.

Immigrants rely on informal networks first

Immigrants rely on informal community networks more than formal financial education, often asking family and friends for guidance before seeking out official resources.

CBOs and ESL programs bridge language, but lack financial expertise.

This leaves immigrants with trusted guides who can translate, but not fully advise and build a proper foundation for success

Hearing First-Gen Realities

Desk research gave me patterns, but not the direct understanding. To explore those insights, we conducted semi-structured interviews with first-generation immigrants and asked them to walk through their experiences with the U.S. financial system.

What We Heard from Participants

Lost in the Jargon

"I don't think they do a good job of making the explanations understandable … technical jargon is explained using more technical jargon."

High Stakes for Small Decisions

"I was just worried that if I do something wrong... or get into legal trouble."

No Resources, No Roadmap

""I lacked the resources and I didn't know how I was even supposed to navigate it [The System]. "

Together, these stories revealed a common thread: first-generation immigrants are trying to navigate a system they were never prepared for. Clear explanations and accessible resources are rarely available, creating a lingering fear that one wrong move could have serious consequences.

Mapping The Mind

As my team and I reviewed our interviews, we needed a structured way to organize what we were hearing across participants. I pulled key quotes onto sticky notes and laid them out as a mental model of the first-generation immigrant financial journey.

Mental Model

During synthesis, I clustered our user data into tall “towers” of blue sticky notes. Each “tower” held a recurring theme, from getting initial guidance and finding information to dealing with emotional barriers and long-term goals. Once those towers were in place, it became much easier to see the bigger patterns and conceptualize potential features that could speak to each need.

OPPORTUNITY

How might we help first-generation immigrants confidently learn and understand the U.S. financial system?

IDEATION

It shouldn’t feel like a maze

The U.S. financial system is already intimidating, but for first-generation immigrants it comes layered with new jargon, unfamiliar rules, and paperwork in a language and culture they’re still learning. We wanted our product to feel less like navigating a distant bureaucracy and more like stepping into a friendly, low-pressure space where first-generation immigrants can get oriented, ask questions, and make decisions at their own pace.

Our Initial Idea: a resource hub + browser helper

Our first concept was a centralized web resource hub. We wanted our users to have a place to gather trustworthy articles, easy to understand terminology, and personalized checklists so first-generation immigrants wouldn’t have to piece information together across dozens of tabs.

My team and I brainstorming product concepts based on our research insights

While this addressed the problem of fragmented information, it still felt like a passive, overwhelming library of information rather than a supportive companion, and it didn’t fully speak to the emotional side of learning or the fear of “messing up” that surfaced in research.

From static library to an adaptive, gamified journey

Our goal shifted from simply “organizing information” to something more interactive. After synthesis, we had a eureka moment: what if, instead of a static library, we reimagined an app as a gamified companion? What if it broke the U.S. financial system into small, doable steps, personalized to each learner and focused on building confidence over time?

A visual replay of our eureka moment from our late-night texts.

REFINEMENT

Working on the Interface

For a more personalized experience, I sketched out different iterations of a personalized onboarding and content experience. I wanted to test how a gamified path would feel from the initial starting point and how it connected to our user's way of thinking.

Because of our time constraints, we kept the course content in low fidelity as a placeholder for future iterations and I focused my mid-fidelity work on the personalized onboarding flow, since onboarding would shape everything a user saw next in their learning path.

Where the Flow Worked and Where It Didn’t

While our half-baked prototypes were slowly coming together, we wanted to get honest feedback and watch where they actually worked, where they fell apart, and what first-generation immigrants had to say about them.

01 Personalization is the right core idea

Participants responded well to getting a tailored set of options instead of being dropped into “everything at once,” which told us to keep personalization as a main element of our design.

02 The flow works, but the words don’t

The overall flow felt intuitive but the content on those screens needed work. Vague questions and dense paragraphs made it hard for users to understand what was being asked of them, so our next step was making our words intentional and breaking information into smaller, scannable chunks.

03 Approachable Tone, Distracting Visuals

Participants described the interface as friendly and approachable, which validated our mascot and conversational tone. At the same time, the visuals felt “distracting,” so we opted for less colors in our palette.

FINAL DESIGN

Introducing, First Spark

First Spark is a financial support app that gives first-generation immigrants personalized paths and support as they navigate the U.S. system. Instead of "one size fits all" content, it adapts to each person’s language, comfort level, and goals, offering culturally tailored lessons, plain-language help, and human guidance when they need it most.

Personalized recommendations from the start

Instead of a wall of content, First Spark creates content based on each user’s language, goals, and comfort with the U.S. financial system, then builds a step by step path that meets them where they are at.

Extra clarity when things get confusing

As users move through their path, an AI glossary, language toggles, and cultural tips appear in tandem each lesson, turning confusing terms into plain language and connecting them to familiar context right when they’re needed.